chanel tax refund australia | Where To Buy CHANEL Bag The Cheapest in 2024? chanel tax refund australia Our legislation states you only need to declare purchases brought back into Australia whereby you have purchased tax free or have received the tax refund.

hours. wed & thu 10pm - 3am. fri & sat 7pm - 3am. sun 10pm - 3am

0 · r/chanel on Reddit: Had global blue tax refund back to original

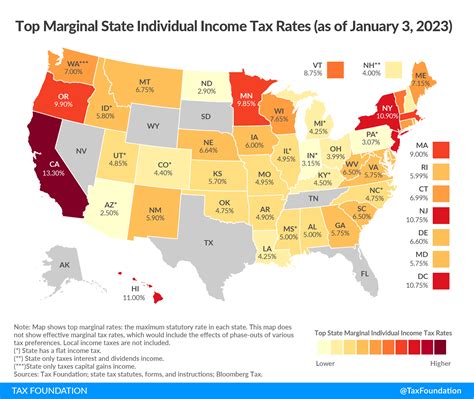

1 · Where To Find Highest Tax

2 · Where To Buy CHANEL Bag The Cheapest in 2024?

3 · Update of Chanel Australia II

4 · The Bag Lover’s Guide to Value Added Tax Refunds in the

5 · Guide To GST Refund In Australia

6 · Fragrance Beauty

7 · Fashion

8 · Chanel Bag Prices in Australia

le 17 mars 2023. Le câble basse tension (BT) fait référence aux câbles dont la tension de travail nominale AC (courant alternatif) ou DC (courant continu) ne dépasse pas 0.6/1KV (inclus). Généralement, les circuits CA inférieurs à 0.6/1 KV sont appelés circuits basse tension, tandis que les lignes 220/380 V sont appelées lignes .LVH by voltage criteria: S wave in V2 + R wave in V5 > 35 mm. LV strain pattern: ST depression and T wave inversion in the lateral leads. Causes of LVH. Hypertension (most common cause) Aortic stenosis. Aortic regurgitation. Mitral regurgitation. Coarctation of the aorta. Hypertrophic cardiomyopathy.

r/chanel on Reddit: Had global blue tax refund back to original

how can i receive a tax refund when making a purchase (excluding department stores)? You can contact us either online or by telephone at 1300 242 635, Monday – Friday, 9:00 AM - 6:00 PM, Saturday 9:00 am - 4:00 pm AEDT, excluding Public Holidays, for any information regarding . But what country offers the highest tax-refund for Chanel bags? Check out our handy table, which provides the VAT percentage amount for . You have bought a lot of Chanel and other high fashion goods and you want your tax back. You can go in two ways: – use the TRS system so . What country offers the highest tax-refund for Chanel bags? How to buy Chanel bag tax free? In this guide, I'm going to tell you which is the cheapest country to buy Chanel and recommend you some best and cheapest place to .

When you shop Chanel in Australia, you can get tax-refund. The tax on goods is 10%. When you leave the country, find the tax-refund counter, fill-in the form and get the 10% tax back. Our legislation states you only need to declare purchases brought back into Australia whereby you have purchased tax free or have received the tax refund.

enssemble gucci

21K subscribers in the chanel community. A place to gather for Chanel lovers.You can return new or gently used products for a full refund back to your original payment method. Online orders can be returned by mail or at your nearest CHANEL boutique within 17 . But what country offers the highest tax-refund for Chanel bags? Check out our handy table, which provides the VAT percentage amount for several countries along with the VAT .how can i receive a tax refund when making a purchase (excluding department stores)? You can contact us either online or by telephone at 1300 242 635, Monday – Friday, 9:00 AM - 6:00 PM, Saturday 9:00 am - 4:00 pm AEDT, excluding Public Holidays, for any information regarding terms and conditions of return and exchange.

If I buy a Chanel purse at Chanel and it’s brand new, I get a full VAT refund at the airport, correct? If I buy a used/second hand Chanel from a store, because its used I will not get my VAT refund. But what country offers the highest tax-refund for Chanel bags? Check out our handy table, which provides the VAT percentage amount for several countries along with the VAT amount after administration fees.

You have bought a lot of Chanel and other high fashion goods and you want your tax back. You can go in two ways: – use the TRS system so your Tax Refund process is quicker – or not use the TRS system If you decide to use the TRS system, go to 2a. What country offers the highest tax-refund for Chanel bags? How to buy Chanel bag tax free? In this guide, I'm going to tell you which is the cheapest country to buy Chanel and recommend you some best and cheapest place to buy new and second-hand Chanel bags online! When you shop Chanel in Australia, you can get tax-refund. The tax on goods is 10%. When you leave the country, find the tax-refund counter, fill-in the form and get the 10% tax back. Our legislation states you only need to declare purchases brought back into Australia whereby you have purchased tax free or have received the tax refund.

21K subscribers in the chanel community. A place to gather for Chanel lovers.

You can return new or gently used products for a full refund back to your original payment method. Online orders can be returned by mail or at your nearest CHANEL boutique within 17 calendar days of the shipping date.

So as long as the store input your information into the VAT system, there’s an automated refund kiosk that you go to and it should automatically apply to your payment card.how can i receive a tax refund when making a purchase (excluding department stores)? You can contact us either online or by telephone at 1300 242 635, Monday – Friday, 9:00 AM - 6:00 PM, Saturday 9:00 am - 4:00 pm AEDT, excluding Public Holidays, for any information regarding terms and conditions of return and exchange. If I buy a Chanel purse at Chanel and it’s brand new, I get a full VAT refund at the airport, correct? If I buy a used/second hand Chanel from a store, because its used I will not get my VAT refund.

Where To Find Highest Tax

But what country offers the highest tax-refund for Chanel bags? Check out our handy table, which provides the VAT percentage amount for several countries along with the VAT amount after administration fees. You have bought a lot of Chanel and other high fashion goods and you want your tax back. You can go in two ways: – use the TRS system so your Tax Refund process is quicker – or not use the TRS system If you decide to use the TRS system, go to 2a.

What country offers the highest tax-refund for Chanel bags? How to buy Chanel bag tax free? In this guide, I'm going to tell you which is the cheapest country to buy Chanel and recommend you some best and cheapest place to buy new and second-hand Chanel bags online! When you shop Chanel in Australia, you can get tax-refund. The tax on goods is 10%. When you leave the country, find the tax-refund counter, fill-in the form and get the 10% tax back. Our legislation states you only need to declare purchases brought back into Australia whereby you have purchased tax free or have received the tax refund. 21K subscribers in the chanel community. A place to gather for Chanel lovers.

You can return new or gently used products for a full refund back to your original payment method. Online orders can be returned by mail or at your nearest CHANEL boutique within 17 calendar days of the shipping date.

Where To Buy CHANEL Bag The Cheapest in 2024?

Update of Chanel Australia II

Got my ten in my hand and a gleam in my eye. I'm a loc'ed-out gangsta, set-trippin' banger. And my homies is down, so don't rouse my anger – fool. Death ain't nothing but a heartbeat away. I'm living life, do or die, what can I say? I'm twenty-three, never will I live to see twenty-four. The way things is goin', I don't know.

chanel tax refund australia|Where To Buy CHANEL Bag The Cheapest in 2024?